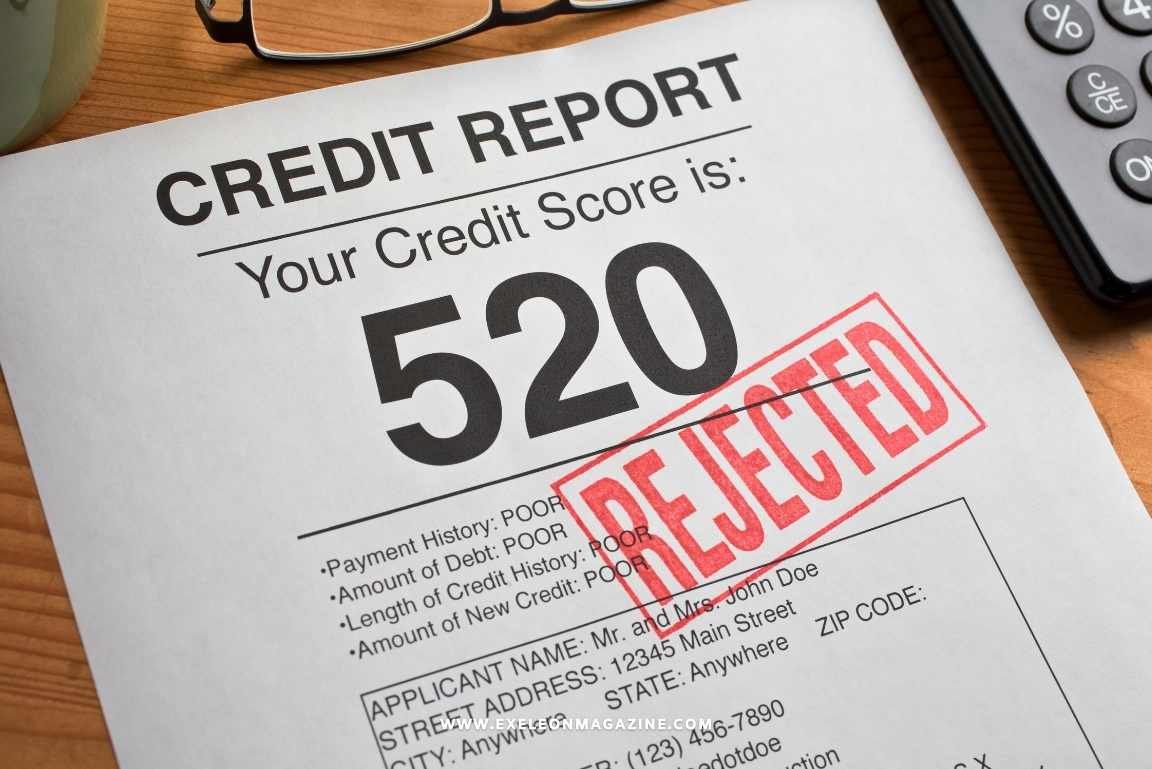

Living with poor credit can be challenging, but that doesn’t have to mean accepting higher interest rates. Alternative lenders who do not perform credit checks or have more relaxed requirements for eligibility could provide the financing solution you need.

Before applying for loans, take steps to strengthen your credit. Save up for a down payment or leverage assets to increase the odds of approval.

Apply for a Credit Card History

No matter your credit history, anyone can apply for a card. But be careful not to overdo it – excessive applications for cards may send the message that you desire more credit than you can responsibly manage and can negatively impact your scores with hard inquiries.

If you have no credit history, the best way to establish it is with a card designed specifically for this purpose. These cards typically feature lower minimum requirements than traditional unsecured credit cards and may provide features like monthly snapshots of your score to help monitor your progress. Alternatively, another way is becoming an authorized user on one of your friends or family member’s credit accounts as long as they can pay all their payments on time – but be careful as becoming added as an authorized user to an account with debt or late payment history can harm both accounts’ credit ratings!

Apply for a Line of Credit

A line of credit provides the flexibility of borrowing whenever needed up to an agreed credit limit, making this type of unsecured loan especially helpful for borrowers with poor credit since qualifying is easier.

Secured lines of credit may also help if your credit is poor. Secured lenders place a lien against an asset you own such as your home or car so they can seize this asset if payments go unpaid.

Before applying for a line of credit, it’s crucial that you do your research and compare lenders. Be sure that you are applying with a reputable lender who has collected all required documents and information; compare interest rates, loan terms, prepayment penalties and storefront locations of various lenders – this way you’re more likely to find one best suited to your unique needs and circumstances.

Apply for a Loan

Assuring your loan approval requires more than having an active credit score. Although having such an active score increases the odds, other factors also come into play; you may still find loan approval even with poor or no credit through using collateral such as personal or business assets, unpaid customer invoices, future credit card transactions or even money in your bank account as leverage.

Lenders often look at various other metrics when assessing risk, including income and employment status. Some lenders may even do a soft credit pull or check alternative bureaus.

If you don’t yet have credit, consider taking out a credit-builder loan – where payments to the debt are reported back to credit bureaus – which allows you to build it slowly but steadily over time. With Chase Credit Journey as your partner in keeping track of progress.

Apply for a Credit Card Cash Advance

Credit card cash advances offer an easy and quick way to access money quickly; however, due to high transaction fees and interest rates they’re also one of the more expensive methods of funding your finances. Before using this form of borrowing money make sure you consider its long-term costs – are they necessary and how you’ll manage repayment.

Cash advances can be secured using your credit card either at an ATM or bank branch with valid identification, although certain card issuers also allow their customers to complete them over the phone.

Remember that a credit card cash advance immediately starts accruing interest at a higher rate than the card’s regular APR; thus it should be paid back immediately or seek help in form of personal loans or increasing your credit limit in order to ease financial strain.

When іt comes tо securing funding, especially for those facing challenges with their credit history, exploring alternative options іs key. Magicalcredit loans for every situation and for every type оf credit provide a lifeline for individuals seeking financial stability. Additionally, for residents оf Toronto іn need оf quick access tо funds, Toronto personal loans up tо $20K offer a practical solution tо immediate financial needs. By considering a range оf borrowing options, from credit cards tо lines оf credit and traditional loans, individuals can find the right fit for their circumstances. It’s essential tо weigh the pros and cons оf each option carefully and tо take proactive steps tо improve credit health over time. With diligence and strategic planning, even those with poor оr nо credit can access the funding they need tо achieve their financial goals.