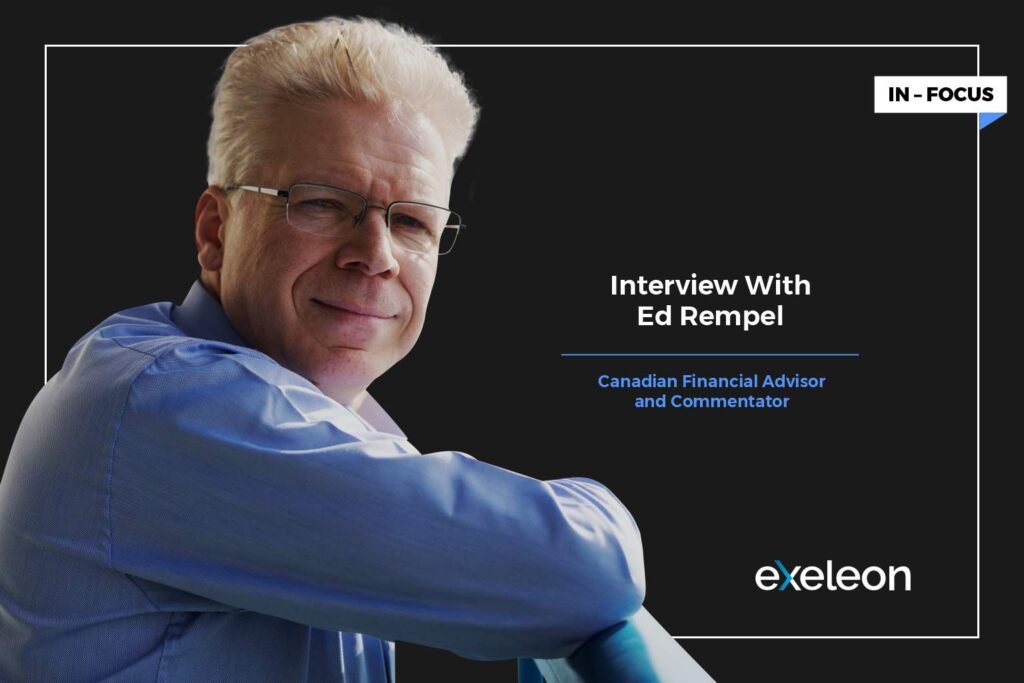

Ed Rempel is more than an experienced financial advisor who is trusted by hundreds of Canadian clients. He is also a proud iconoclast, the star of a popular podcast titled Unconventional Wisdom.

A CFP, CPA, CMA and certified hedge fund specialist, Rempel helps create financial independence by going against the grain. In his three decades of experience, he’s seen firsthand the damage the herd mentality can do to the financial health of ordinary investors.

From his home base in the Greater Toronto Area, he broadcasts his advice across a full spectrum of communication platforms, from his website and podcast to videos, articles, blogs, and thought pieces.

Recently, Ed Rempel agreed to share his insights with our readers, in an intriguing discussion reprinted below.

Q: What are Lifecycle Investing strategies?

Ed Rempel: Lifecycle Investment strategies are designed to avoid risk when you can least afford it; in the last decade before you retire. If you invest for retirement for 40 years, but your last decade has a low return, then your 40-year return will be low. You likely have a far larger portfolio in your 50s and 60s than in your 20s and 30s.

According to the principles of Lifecycle Investing, young people should save for retirement the same way they buy a home–by utilizing a large investment loan when they’re young, paying it off slowly during their 40s and 50s, and then moving to their target asset allocation in their 60s.

When implemented, Lifecycle Investment strategies have improved retirements 100% of the time over the last 100 years, based on the results from a study by 2 university professors in their book “Lifecycle Investing”. That being said, it can be quite challenging for young people to obtain large investment loans, so executing Lifecycle Investment strategies can take some creativity.

Q: How can homeowners in Canada benefit from the “Smith Manoeuvre”?

Ed Rempel: The “Smith Manoeuvre” is a quirky name, but it really works, and it can be an incredibly effective part of a larger financial plan. I will caution that it is not for everyone, but if done by the right people in the right way over the long term, it can be very beneficial. The main benefit of using it is saving for retirement without using your cash flow. When used properly, it typically doubles your retirement portfolio. It’s essentially a way to leverage the otherwise dead equity in your home.

The way it works is by converting your mortgage to a tax-deductible credit line over time, you can use these newly available funds to purchase investments, such as stocks or equity mutual funds, which amounts to extra retirement investments. If invested tax-efficiently for growth, this should also ensure a tax refund most years.

So, instead of waiting to access your equity when you sell your home late in life, you can use it effectively throughout your entire life.

Q: Of all the conventional wisdoms out there, which one is the most damaging to the financial well-being of ordinary Canadians?

Ed Rempel: First, I think one of the most common errors most Canadians make is mapping out their financial plan with the wrong mentality. You want to envision where you want to end up in life first, and then use that goal as a starting point from which to work backwards and develop a plan. You want to know exactly how much money you’ll need to retire comfortably with the lifestyle you will want after you retire and then build your financial plan around that. Without an end goal to work towards, the financial plans that most people adopt simply amount to saving whatever you can and then investing it aimlessly. Although you may see good returns by doing this, they will not be optimized to facilitate a comfortable retirement, and you will end up retiring with far less money than you could’ve had otherwise.

However, armed with a comprehensive and detailed plan for retirement, you may do things differently – invest the right amounts, choose different taxable incomes or deductions, execute different tax & investment strategies – because you know ahead of time where you ultimately want to end up. I often tell people to think of their financial plan as a GPS for their lives.

Second, another common error Canadians tend to make involves asset allocation. Man people choose a conservative or moderate asset allocation because they believe that you can’t afford to lose money. The default position of the investment industry is to recommend a balanced portfolio which is likely to give you a long-term return of about 5% per year, but almost nobody can retire comfortably on that. This fact is not widely known, unfortunately, either with the investing public or among the majority of advisors.

In order to increase your returns, you have to learn to tolerate risk. This is a learned skill that can be cultivated over time – in fact, I would call it the most important investment skill to learn. If you can master it and apply it confidently to an equity-focused portfolio, you’ll end up with a much larger nest egg. For most people, this one skill means they are likely to retire with more than $1 million more.

People who study the stock markets know that they fluctuate over the short- and medium-term, but over the long-term, they inevitably go up a lot. Based on history, the stock market will likely be between seven to seventeen times higher in 25 years. Equities are actually much more reliable than bonds or fixed incomes after inflation over 25-year periods.

Q: From a financial planning standpoint, what are some of the most effective ways to become financially independent when you have created a successful business?

Ed Rempel: The best tip I can recommend to business owners is to use your corporation as your retirement fund, as opposed to your TFSA or RRSPs. If you make investments from inside your corporation, you’ll receive a 31% tax deferral. Then, if you invest tax-efficiently, you can invest the money you retain from those deferrals for many years, thereby increasing your retirement portfolio.

Q: What is the Cash Dam?

Ed Rempel: The Cash Dam is a pure tax strategy. There is no risk involved, but it is a little tricky to implement. Basically, it’s a method for people with a sole proprietorship (a company that is not incorporated) or rental property owners to convert their home mortgage into a business or rent expense.

To do this, you have to get a readvanceable mortgage. Then you take the gross revenue and pay it onto your mortgage, and then borrow from a linked credit line to pay all business or rent expenses. By doing this, your home mortgage declines and the business credit line grows. And the credit line interest is tax-deductible.

Q: What are the best ways younger and middle-aged Canadians should save and invest for their retirement?

Ed Rempel: I would advise younger and middle-aged Canadians to invest in whatever offers the “highest long-term reliable returns after tax”. Looking for high returns that are reliable over time is far more effective for your retirement plan than looking for “reasonable returns with less risk”.

To that end, equities are the highest return asset class and have been very reliable over the long term. Once again, I’ll reiterate how crucial it is to have a financial plan in place, so you know how much you have to save and where to save it to pay the lowest lifetime tax.

Q: Can you please describe the “Rempel Maximum”?

Ed Rempel: The “Rempel Maximum” describes the largest amount you can invest without using your cash flow. It’s related to the “Smith Manoeuvre”. With the “Smith Manoeuvre”, you invest monthly from a credit line without using your cash flow. With the “Rempel Maximum”, you use that monthly amount for an investment loan or credit line payment.

For example, if your mortgage payment pays $1,000 per month principal, you would invest that $1,000 per month according to the “Smith Manoeuvre” directly from a credit line. With the “Rempel Maximum”, if you obtain an investment loan or credit line with interest-only payments of $1,000 per month. This would be about $250,000. You would invest the whole of the $250,000 once, instead of $1,000 per month for years. By doing this, you reap the maximum benefit that all that money can accrue over time – hence the name. It works out to be a huge jump-start on your retirement plan.

Q: What do you see on the horizon over the next year in terms of the performance of equities?

Ed Rempel: Over the short-term, equities are not predictable. Long-term, they have always risen. That’s why I don’t make short-term stock market predictions. I just always assume the markets will be up seven to seventeen times over a 25-year period. There is a great deal of evidence to back me up on this, based on calendar year gains of the S&P 500 over 25-year periods since 1930, which was the starting point for the modern stock market. Meanwhile, over one-year periods, the markets are up 75% of the time and down 25% of the time.

That’s why, when it comes to investing, it is critical to be confident in your investments, so you stay invested over the long-term. Making one-year predictions might lead you to suboptimal actions, such as investing less or more conservatively some years. I’m of the opinion that people who do not make market predictions have higher returns than people that do and are ultimately much better off.