American money was once as good as gold. The nation’s promissory notes were exactly that — a promise to redeem paper for precious metals, whenever a bearer presented a note.

That all changed in 1971 when President Richard Nixon canceled the direct convertibility of the U.S. dollar to gold, taking the nation off the gold standard. A half-century later, it’s another Republican who is on a mission to restore gold to its central place in the prosperity of the nation, and the stability of its economic system.

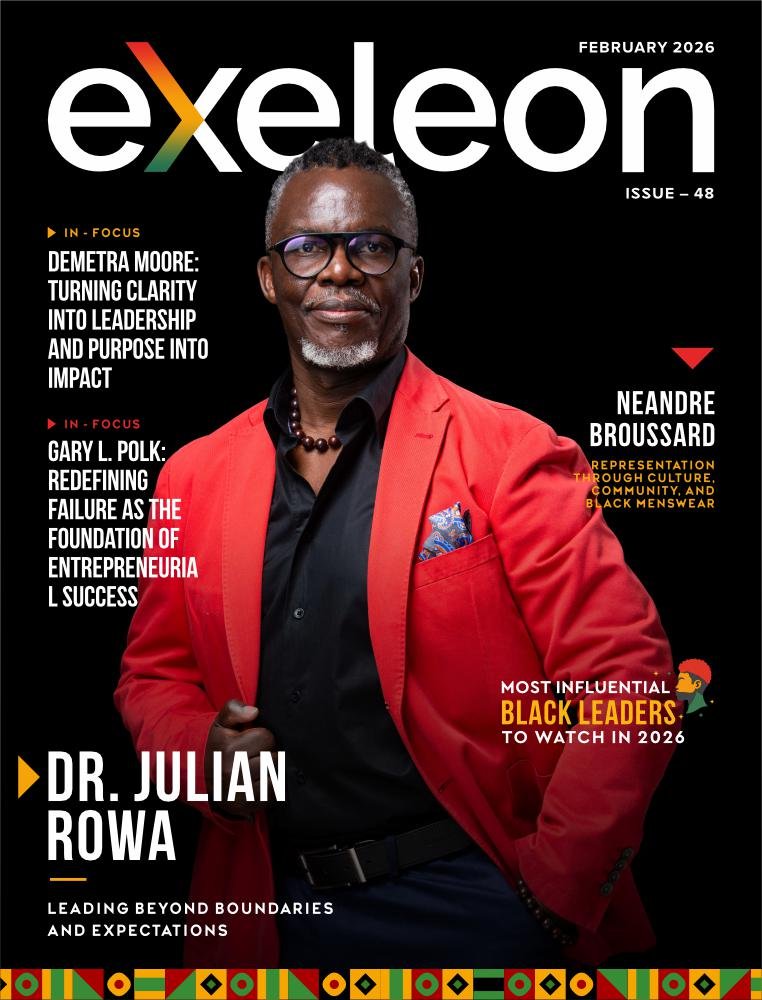

His name is Alexander Spellane, and he’s the founder of Fisher Capital Group. He is as well-known for his political activism as he is for the success of his business, which Forbes has listed among “America’s Fastest Growing Precious Metals Companies.”

The California-based precious metals retailer promotes gold and silver as a prudent way to diversify and add security to investment portfolios and IRAs. Alexander Spellane founded Fisher Capital in 2007, and those who followed his investment advice then have been richly rewarded: Gold has tripled in value since that time.

Ordinary Americans and central banks around the world can’t get enough of gold. It’s the one thing of enduring value that still offers hope and security, a safe harbor in troubled times. Gold is kryptonite to the forces of inflation, currency devaluation, economic implosion, soaring national debt, collapsing financial institutions, tariff wars, social unrest, and worldwide military conflict.

In this interview, Alexander Spellane shares his perspectives on precious metals diversification, politics, and the global financial trends that are putting millions of Americans back on the gold standard, one portfolio at a time.

Q: You made your first million before you turned 30. Is that success still possible for young people today? Is the American Dream alive for the newest generations?

Alexander Spellane: It’s a different world now, but I think absolutely, the American Dream is still alive, and success is attainable for young people today. It’s still a country where hard work, strategic planning, and knowing how to seize opportunities when they arise will get you ahead. There are a lot of avenues for financial success, including precious metals, which still provides stability and growth potential, much like they did for me when I first started Fisher Capital.

Q: Fisher Capital advertises its access to limited-mintage bullion coins, which are often hard to find. What is the unique appeal of this type of investment?

Alexander Spellane: Limited-mintage bullion coins are unique because they combine the intrinsic value of precious metals with the rarity of a collectible coin, which significantly enhances their value over time. These coins are attractive to collectors as they often have historical or artistic significance, allowing them to maintain and in most cases significantly increase their value over time. They’re smart investments.

Q: Is cryptocurrency the new gold, or simply a gilded imitation of gold’s time-tested value?

Alexander Spellane: Cryptocurrency and gold serve different purposes. While cryptocurrency is an innovative new form of digital transactions, and exciting because of that, gold remains the time-tested store of value. Gold’s physical presence and historical stability make it unbeatable in terms of financial security. Gold is a tangible asset that exists outside of the current fiat currency system. Its value isn’t tied to stocks, bonds or currencies; governments or groups of governments. As JC Morgan once said “Gold is the only real money, everything else is just credit.” Cryptocurrency still has to prove its long-term viability.

Also Read: Daryl Appleton: Unlocking Potential with The Success Doctor

Q: What role should gold play in planning for a secure retirement?

Alexander Spellane: I think gold should be a key component of any secure retirement plan. Its value tends to remain stable or increase during economic downturns, providing a hedge against inflation and market volatility. A physical gold IRA can add a layer of diversification and security, ensuring that a portion of your retirement savings is protected from the fluctuations of traditional financial markets.

Q: You emphasize the term “diversification” over “investment” when discussing precious metals. Why is that?

Alexander Spellane: Diversification is about spreading risk and not putting all your eggs in one basket. Precious metals, like gold and silver, offer a counterbalance to traditional investments such as stocks and bonds. By diversifying, investors can protect their portfolios from fluctuations in the market, allowing for more stable and secure financial growth.

Q: What are the logistics of purchasing gold from Fisher Capital?

Alexander Spellane: It’s very straightforward. Clients can choose between direct purchases, where the metals are shipped to their doorstep, or they can purchase within a retirement account, where the metals are stored in a secure repository. We handle all aspects of the transaction, from conception to delivery or storage. We’ve created a seamless and secure process for our clients.

Q: Do you offer any price or buy-back guarantees?

Alexander Spellane: Yes, we offer competitive buy-back guarantees. If clients decide to sell their precious metals, we provide a transparent and fair process. We maintain market-competitive prices for both buying and selling.

Q: Traditional American values are a key part of your company identity. How do you strike a balance between political advocacy and precious metals retailing?

Alexander Spellane: We believe that supporting traditional American values complements our business model. Our advocacy for these values is reflected in our commitment to transparency, integrity, and service to our clients. While we are passionate about our political beliefs and our convictions for the best direction for this country, our primary focus remains on providing exceptional value and service to our customers in the precious metals market.

Q: This year Fisher Capital will launch a charitable foundation focused on helping U.S. veterans. What was the genesis of this idea, and how do you see the foundation making an impact in the lives of veterans and their families?

Alexander Spellane: The idea for the foundation came from our deep respect for the sacrifices made by our military veterans. We’ve always supported veterans through employment opportunities and charitable initiatives. The foundation will expand this initiative, focusing on programs that provide education, healthcare, and housing assistance, making a real difference in the lives of veterans and their families, and honoring their service to our country.

Also Read: Interview With Ed Rempel, Canadian Financial Advisor and Commentator